Segment description

Comments

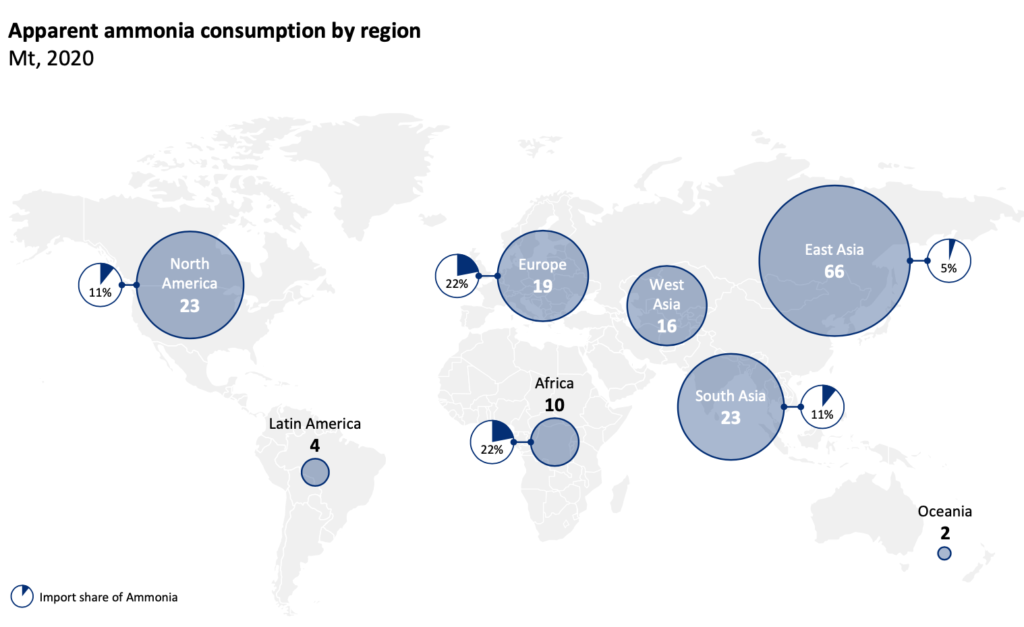

East Asia with the highest demand for ammonia (>35% of the worlds consumption), however with one of the lowest import shares of 5%

Europe, North America and South Asia as major ammonia consuming countries after East Asia

– Europe with the highest import share of 22% as the most attractive market (North America/South Asia at 11%)

Of remaining markets Africa is the most relevant with the fastest growing consumption over the past years (CAGR 2010-2020: >3%) and an import share of 22%

Key takeaways